August 23, 2021, LOS ANGELES, CA – Century Park Capital Partners (“Century Park”) is pleased to announce that it has completed the sale of Covercraft Industries (“Covercraft”) to Audax Private Equity.

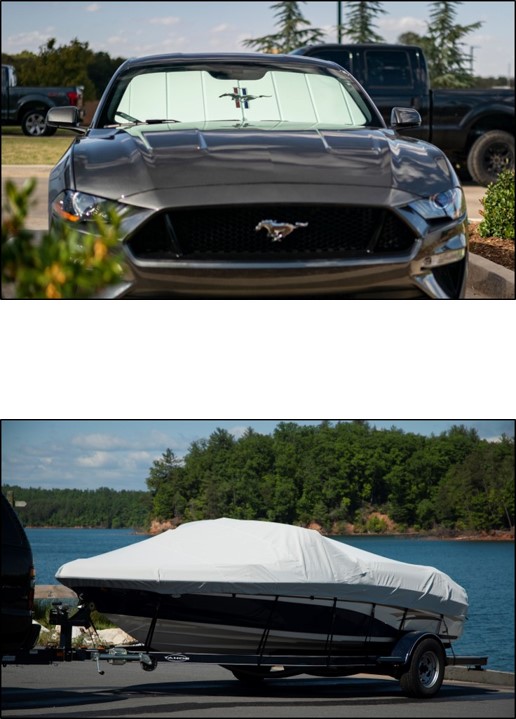

Covercraft is a leading branded manufacturer of custom vehicle protection products including automotive covers, seat covers, front end masks, dashboard covers, window sunscreens, RV covers, boat covers, and other products that “protect the things that move you”. The company focuses on custom-fitted covers with a library that includes more than 300,000 patterns for distinct automotive, marine and outdoor protection products.

Covercraft was founded by Bob Lichtmann in 1965, who established the company as a leading brand in the custom automotive accessory market. His son, Marty Lichtmann, served as President and CEO when the family sold majority control of the company to Century Park in 2015. Marty Lichtmann partnered with Century Park through a rollover investment and remained active in the business by serving on the board of directors.

Century Park developed a Value Creation Blueprint to accelerate the company’s growth and improve its margin profile by establishing a direct-to-consumer channel while also expanding into new product lines, both organically and through acquisition. Since Covercraft launched its direct-to-consumer website in 2016, sales through that channel have grown organically nearly sevenfold. In addition, the company completed five add-on acquisitions, expanding Covercraft’s product assortment, distribution channels and manufacturing capabilities. Through this combination of organic growth and acquisitions, Covercraft’s earnings grew nearly eightfold under Century Park’s ownership.

Century Park developed a Value Creation Blueprint to accelerate the company’s growth and improve its margin profile by establishing a direct-to-consumer channel while also expanding into new product lines, both organically and through acquisition. Since Covercraft launched its direct-to-consumer website in 2016, sales through that channel have grown organically nearly sevenfold. In addition, the company completed five add-on acquisitions, expanding Covercraft’s product assortment, distribution channels and manufacturing capabilities. Through this combination of organic growth and acquisitions, Covercraft’s earnings grew nearly eightfold under Century Park’s ownership.

The investment was led by Guy Zaczepinski, Managing Partner with Century Park, who commented, “Covercraft has become a leading player in custom vehicle protection, with strong market share across the automotive, RV and marine categories. The company’s product lines – in seat covers, automotive covers, marine covers, dash covers, and window sunscreens – are best-in-class. We owe an enormous debt of gratitude to the entire Covercraft workforce; they have worked tirelessly, especially in this most challenging environment, to keep building products. What the team has achieved is impressive, and they are only getting started; the future for Covercraft is very bright.”

Adam Zacuto, Vice President with Century Park, added, “It has been a privilege working with Matt Jordan and the rest of the Covercraft management team, who have done a tremendous job growing the business both organically and through acquisitions. We are proud to have partnered with such an iconic brand and played a role in the company’s success.”

Matt Jordan, CEO of Covercraft, said, “The Lichtmann family started Covercraft with a focus on creating the best vehicle protection products possible – and did so with a huge emphasis on integrity and quality. Century Park was an outstanding partner and well-aligned to build on that foundation: opening up the direct-to-consumer channel, expanding into new segments like RV and marine, and further growing the seat cover category. By tapping into the skills and dedication of the people on the Covercraft team, we have added to the legacy of a company that stands for protecting the things that move our customers. I’m terrifically proud of what we’ve accomplished and look forward to taking the next steps on our future path with our new partners at Audax.”

Matt Jordan, CEO of Covercraft, said, “The Lichtmann family started Covercraft with a focus on creating the best vehicle protection products possible – and did so with a huge emphasis on integrity and quality. Century Park was an outstanding partner and well-aligned to build on that foundation: opening up the direct-to-consumer channel, expanding into new segments like RV and marine, and further growing the seat cover category. By tapping into the skills and dedication of the people on the Covercraft team, we have added to the legacy of a company that stands for protecting the things that move our customers. I’m terrifically proud of what we’ve accomplished and look forward to taking the next steps on our future path with our new partners at Audax.”

Marty Lichtmann concluded, “When you relinquish control of your 50-year-old family business you hope your new partners will respect the traditions, the culture, and the team you have created. My association with Century Park has been everything I could have hoped for and more. It has truly been an honor and a pleasure to work with Guy, Adam, Matt, and the rest of the board, plus the management team put in place to shepherd Covercraft’s growth through this exciting time. They have done an outstanding job creating value and positioning the company for the future with our new partners.”

Stifel, Nicolaus & Company, Incorporated (“Stifel”) served as financial advisor and Winston & Strawn LLP served as legal advisor to Covercraft in this transaction.

About Covercraft:

Covercraft Industries, LLC is a leading branded manufacturer of vehicle protection products including automotive covers, seat covers, front end masks, dashboard covers, window sunscreens, RV covers, marine covers, patio furniture covers and other products that preserve and protect the things that move you. The company focuses on custom products with a library that includes more than 300,000 patterns for distinct automotive and outdoor protection fitment. Covercraft operates manufacturing locations with Quality Management Systems that are certified to ISO9001 and IATF16949. In addition, the Covercraft Environmental Management System is certified to ISO14001.

Founded in Southern California in 1965, Covercraft is headquartered in Pauls Valley, Oklahoma with additional manufacturing facilities in California, Colorado, Texas, South Carolina, Montana, and Mexico. For more information, please visit www.covercraft.com.

About Century Park Capital Partners:

Century Park Capital Partners is a Los Angeles-based private equity group established in 2000 that invests in family businesses, owner-operated firms and corporate divestitures with the purpose of accelerating growth and transforming these companies into leading industry players. We specialize in acquiring strategically well-positioned yet under-resourced middle market companies with identifiable potential for value creation. We leverage the domain expertise of the Century Park Executive Council to work with management to implement a Value Creation Blueprint for our portfolio companies. We further support our investments with proven operational and best practice initiatives, led by our Operating Team, including buy-and-build acquisition integration programs and infrastructure additions. For more information on Century Park, please visit www.centuryparkcapital.com.

About Audax Private Equity:

Audax Group is a leading alternative investment manager with offices in Boston, New York, and San Francisco. Since its founding in 1999, the firm has raised over $30 billion in capital across its Private Equity and Private Debt businesses. Audax Private Equity has invested over $7 billion in more than 140 platforms and over 1,000 add-on companies, and is currently investing out of its $3.5 billion, sixth private equity fund. Through its disciplined Buy & Build approach, Audax Private Equity seeks to help platform companies execute add-on acquisitions that fuel revenue growth, optimize operations, and significantly increase equity value. With more than 250 employees, Audax is a leading capital partner for North American middle market companies. For more information, visit the Audax Private Equity website: www.audaxprivateequity.com or follow us on LinkedIn.